“The first thing we do, let’s Change the Money”

An idea whose time has come.

In Shakespeare’s Henry VIII, during a rebellion Dick the Butcher utters the line, “The first thing we do, let’s kill all the lawyers.” However, the line did not advocate killing lawyers but was a satirical remark underscoring the important role lawyers play in society; that lawyers, by upholding the law and administering justice, are impediments to tyranny. RFK jr’s efforts come to mind. He’s just the lawyer to begin rescuing public health and medical science from the corporate maw. Of course, there are also lawyers helping feed the insatiable greed of the corporate beast. One must remember there is always a choice between good and evil. Lawyers, and why I referred to that quote, will also play an important role in changing our 400-year-old and unjust monetary system because money is embodied by law. As Edgar Wortman of the Dutch monetary reform group Ons Geld noted “Economists deal with assumptions, lawyers deal with facts.” Lawyers are better suited for monetary reform.

“All power is originally vested in, and consequently derived from, the people. That government is instituted and ought to be exercised for the benefit of the people; which consists in the enjoyment of life and liberty and the right of acquiring property, and generally of pursuing and obtaining happiness and safety. That the people have an indubitable, unalienable, and indefeasible right to reform or change their government whenever it be found adverse or inadequate to the purpose of its institution.” -- James Madison (1751-1836), Father of the Constitution, 4th President

The U.S. Constitution established We the People as the sovereigns of this nation, as well as the purpose of our government, in its very first sentence. It also gave Congress the power to create money, which as Frederick Soddy pointed out, even the ancient Greeks acknowledged it as the most vital prerogative of democratic self-governance. Unfortunately, Congress handed our sovereign right to create money over to a cabal of the nation’s biggest banks through some legislative sleight of hand in 1913. This meant that instead of our government issuing debt-free, permanently circulating asset money, we would have to borrow the entire money supply, public and private, from the banking industry which they dominated. We also got the income tax because the banks wanted to make sure the government could pay the interest on the massive amount of money they intended to lend to us. Two years later they gave us our mandatory schooling system, based on the Prussian model, to assure the bankers would have a compliant and obedient work force for the massive industrialization they were about to invest in.

There will of course need to be several other steps made before We have a Congress so dedicated to the public interest that they would change the ‘first cause’ of our nation’s money from the personal gain of wealth and power for a few, to creating broad-based prosperity for all and common good public care. The good news is we already have the legislation written that would change the system. It was based on the 1933 Chicago Plan, that would have ended the Great Depression and was introduced to Congress in 2011 as The NEED Act, HR 2990, by Dennis Kucinch as a response to the 2008 financial crisis in which Obama bailed out the banks after they had robbed five and a half million people of their homes. If passed it would stabilize the economy and take back public control of public policy, now controlled by Big Money, the banks who own the Fed. It was not allowed out of committee for a vote and Dennis was promptly primaried out of office by his own party. As they flail about not knowing what to do while it seems the nation is drifting inexorably into the Greatest Depression, they should apologize to him and pass the bill.

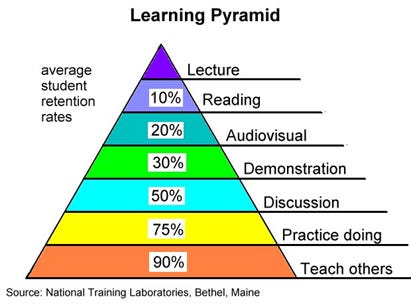

To win back our sovereign right to issue money, which Benjamin Franklin said was the real reason behind the American Revolution, will require educating the public on a subject that has never been taught in any of our schools. Even at the university level money is considered a third order of importance and that studying it is widely discouraged as a bad career move. It is not an approved field of study and yet how could that be? Where would our society be without money, a vital cultural artifact that influences how people interact, what they value, and even how they define success. It is of course Big Money that doesn’t want us to know. They fund the universities, control the industries and governments, and most importantly, the source of their power, the creation of money. Thus, it is in the field of independent study. As Mark Twain said, “Education isn’t something a school gives you, it is something you must give to yourself.” Along with that idea is the ‘Learning Pyramid’ the results of a study on average student retention rates.

The study provided proof of efficacy for the phrase, “Each one Teach one” a phrase originated in the United States during the time of slavery. Africans were denied education and not allowed to learn to read. Of course, they did it anyway and when one person learned or was taught to read, it became their duty to teach someone else, spawning the phrase “Each one teach one”. As the study showed, that is the best way to retain what you learn. So, learn about the money but avoid going too deep into the complexity of the current system, it is designed to be deceptive, and many are deceived. Complexity is often a device for claiming sophistication and is used to disguise or to evade truth, not to reveal it. You can begin by looking at the monetary bibliographies at monetary.org or monetaryalliance.org to find a wealth of materials for further study. There are many good books out now on the subject, but my two favorites are New Money for a New World by Bernard Lietaer and The Lost Science of Money by Stephen Zarlenga.

All this is to tell readers that all the major issues affecting humanity and the planet can be traced to the power to create money being in the hands of private profit-motivated interests and to implore you to look at the monetary history and current scholarship which you can find at the American Monetary Institute at monetary.org and join the monetaryalliance.org then share it all widely. If we want to create a movement to change our system, We the People need to know what needs to be changed that will make the rest of the needed changes possible.